News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Worldcoin (WLD) To Bounce Back? Key Harmonic Pattern Signals Potential Upside Move2Why the TRUMP Meme Coin is Unlikely to Recover Anytime Soon3Bitcoin ETF In Red After Historic IBIT Pullback

Elon Musk cleared in Dogecoin class action lawsuit

Elon Musk and Tesla won the dismissal of a class action lawsuit, which alleged Musk’s comments manipulated the Dogecoin market.U.S. District Judge Alvin Hellerstein dismissed the lawsuit permanently.

The Block·2024/08/30 07:00

Altcoin season hasn't arrived because everyone jumped 'straight to the punchline'

A crypto analyst says that we haven’t seen this altcoin season because traders keep buying memecoins too early.

Cointelegraph·2024/08/30 06:12

Top 5 Blockchain Projects You Can’t Afford to Miss

Cryptonewsland·2024/08/30 05:54

JASMY Charts Indicate Something Much Greater Unraveling for the Bitcoin of Japan, When Will JasmyCoin’s True Value Shine?

Cryptonewsland·2024/08/30 05:54

BlackRock’s IBIT logs first daily net outflows since May amid streak of spot bitcoin ETF outflows

U.S. spot bitcoin ETFs saw $71.73 million in net outflows on Thursday.BlackRock’s IBIT logged $13.51 million in outflows, marking its first daily negative flows since May 1.

The Block·2024/08/30 05:31

Ethereum whales reduce holdings amid double-digit price dip

Grafa·2024/08/30 04:15

Crypto options worth $5 billion expiry today

Grafa·2024/08/30 04:15

Web3 Lawyer: MakerDAO Brand Upgrade, Disillusionment with DeFi and Decentralized Stablecoins?

曼昆区块链法律服务·2024/08/30 03:11

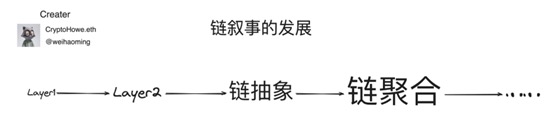

How to view the current chain narrative and its future development

cryptoHowe.eth·2024/08/30 03:06

Could OpenAI’s New Funding Round Trigger a Crypto Rally?

Cryptonewsland·2024/08/29 21:18

Flash

- 10:50CME FedWatch: Probability of a 25 Basis Point Rate Cut in June is Only 2.6%According to CME "FedWatch" data, with 10 days remaining until the next FOMC meeting, the probability of a 25 basis point rate cut in June is 2.6%, and the probability of maintaining the current rate is 97.4%. The probability of the Fed maintaining the rate unchanged until July is 83.3%, with a cumulative 25 basis point rate cut probability of 16.3%, and a cumulative 50 basis point rate cut probability of 0.4%.

- 10:50Crypto market sentiment rises from "neutral" to "greed", today's Fear and Greed Index at 62According to Alternative data, today's cryptocurrency Fear and Greed Index is 62, up from 52 yesterday, with market sentiment rising from "neutral" to "greedy". Note: The Fear Index threshold is 0-100, including indicators: volatility (25%) + market trading volume (25%) + social media popularity (15%) + market surveys (15%) + Bitcoin's proportion in the entire market (10%) + Google keyword analysis (10%).

- 10:50OpenEden CEO: Beware of the "Too Big to Fail" Concept, RWA Tokenization Requires Prioritizing Risk AssessmentOpenEden founder and CEO Jeremy Ng stated that the industry should remain highly vigilant against the "too big to fail" concept. Jeremy Ng drew a parallel with the Lehman Brothers collapse, pointing out that in the realm of Real World Asset (RWA) tokenization, risk assessment should be balanced with opportunities. He emphasized that even the largest institutions can fall, thus proper structural design and compliance are non-negotiable fundamental requirements.