Solana (SOL) Shows Signs of Resilience Amid Funding Rate Decline and Key Price Resistance

As a prominent player in the crypto landscape, Solana demonstrates dynamic resilience despite recent market fluctuations.

-

SOL witnessed a slight dip in its funding rate, indicating potential short-term corrections.

-

Nonetheless, the altcoin maintains a bullish long-term outlook amidst a predominantly bearish backdrop.

This article explores Solana’s unique market position, its recent funding rate dynamics, and active user engagement as key metrics of its strength.

Negative Funding Rate Signals Potential Short-Correction Opportunities

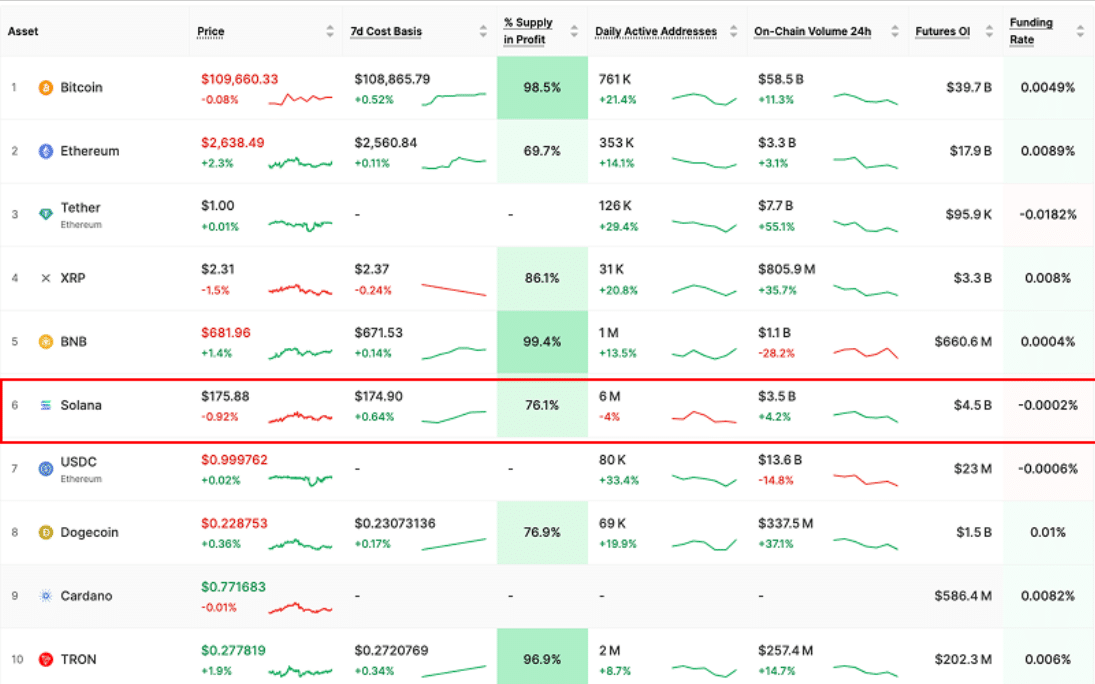

At the time of writing, Solana (SOL) stood out as the only top 10 cryptocurrency, excluding stablecoins, with a negative funding rate of -0.0002%. This figure, although seemingly minor, could signal that underlying pressure is building against short positions in the market.

The funding rate is an essential indicator, reflecting the sentiment in derivatives markets. When it dips below zero, it suggests that short sellers are actually subsidizing long positions, creating a mildly bearish sentiment. This trend is especially notable given the general positive or neutral funding rates observed in other cryptocurrencies.

Source: Glassnode

Increasing Active Addresses: A Sign of Long-Term Strength

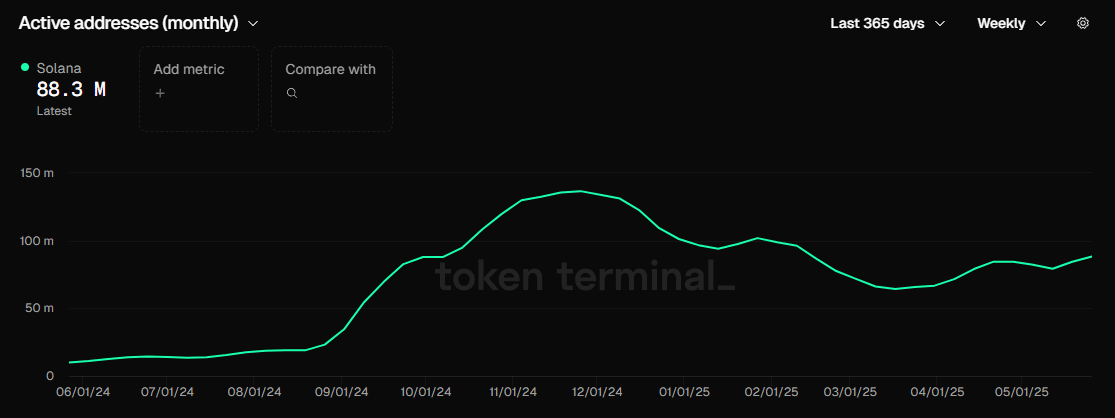

In contrast to the negative funding rate, on-chain metrics indicate a positive trend. The number of active addresses using Solana has steadily increased, showcasing persistent engagement from users and investors. This growth signifies confidence in the network’s long-term viability.

An expanding base of active users is a strong indicator of a healthy ecosystem, capable of sustaining price growth even in the face of speculative short positions.

Source: Token Terminal

$175 Supply Zone Remains Critical for SOL

Technically, Solana’s price has been consolidating around the $175 level for the past two weeks, a significant supply zone where bearish activity has increased. This price level has witnessed numerous sell orders, accompanied by heightened trading volumes.

Despite several attempts to break through this resistance, SOL’s price continues to oscillate in a congested pattern since May 9, indicating that both bulls and bears are awaiting concrete indicators for their next moves.

Source: TradingView

Overall Bullish Market Structure Remains Intact for Solana

Despite the negative funding rate and resistance levels at $175, Solana’s broader market structure appears bullish. Analysis of SOL’s price action over longer periods supports the notion that bullish momentum remains strong.

The increase in activity from long-term investors reaffirms this bullish sentiment. Though caution is warranted regarding short-term fluctuations, the outlook for SOL remains favorable for potential upward price movement.

Conclusion

In summary, while Solana’s funding rate presents signs of short-term corrections, other indicators, including active addresses and market consolidation, remain solidly in its favor. This nuanced data implies that long-term holders can remain optimistic, as the overall market structure continues to support potential gains for SOL.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Michael Saylor Posts Bitcoin Tracker Again, Will Strategy Announce Another BTC Purchase Tomorrow?

Ripple Partners with Web3 Salon to Fund XRPL Startups in Japan with $200K Grants

Aptos (APT) and Starknet (STRK) lead $341 million token unlocks this week

Share link:In this post: Aptos leads large token cliff unlocks with $53.38 million release. Solana dominates linear unlocks with $70.83 million weekly value. Multiple smaller projects add pressure with combined unlock events.

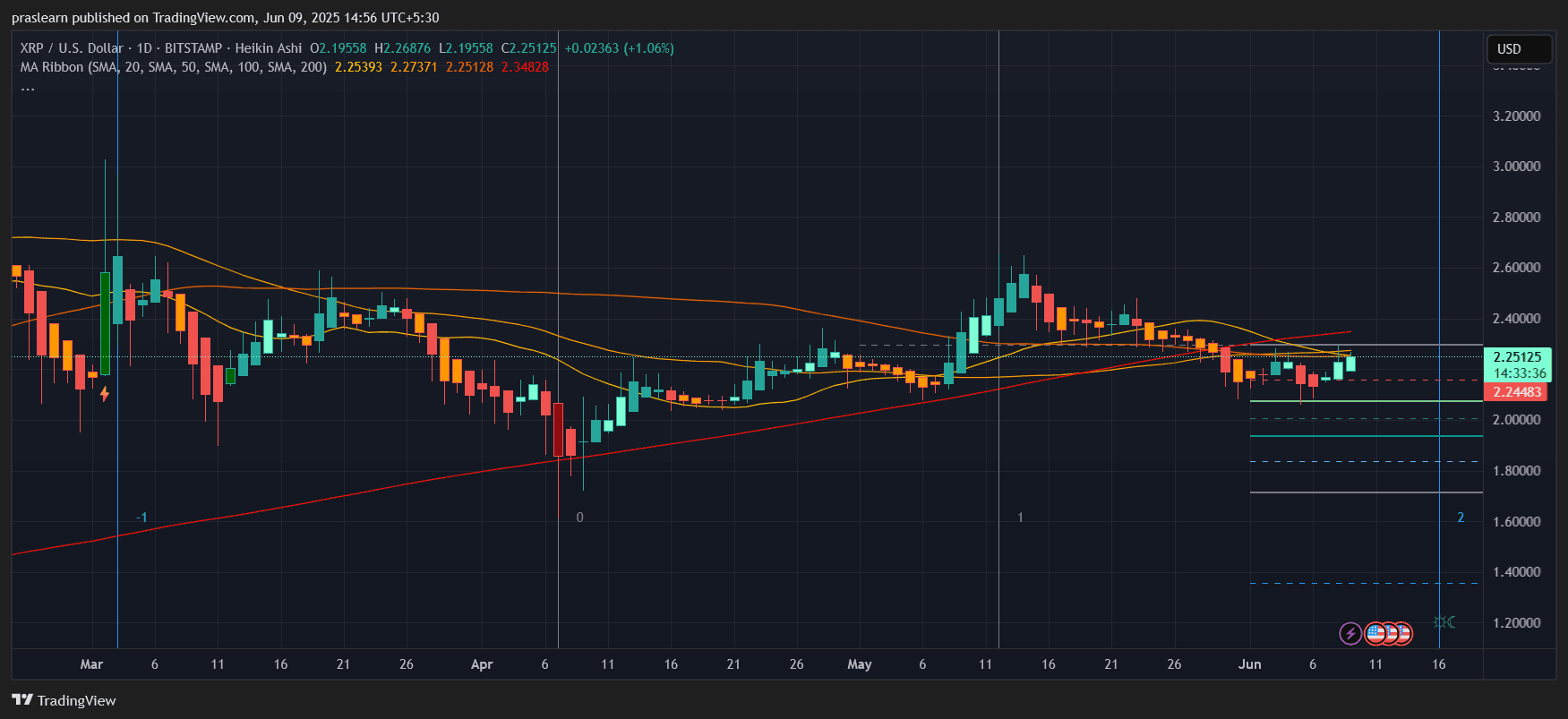

XRP Price Prediction: Will This Breakout Rally Sustain?