Spike Alert: Solana Targets $233 if $180 Resistance Breaks

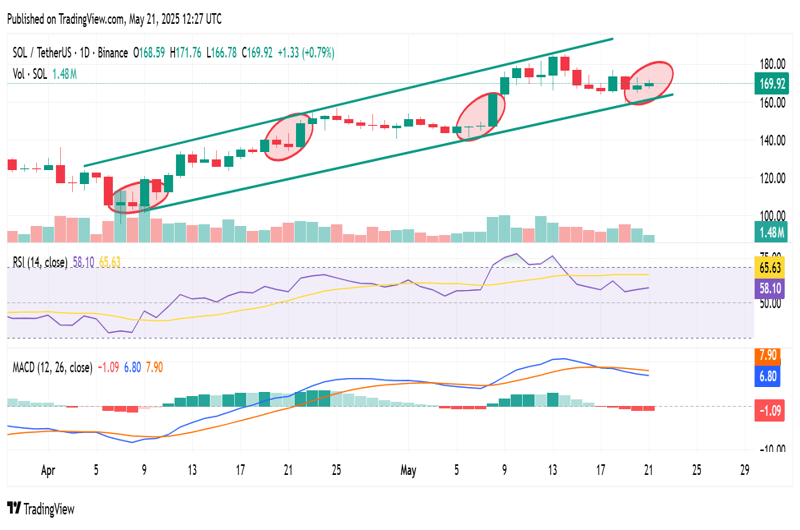

- SOL’s disciplined uptrend sees sustained higher lows since April, with $180 acting as a pivotal resistance in the ascending channel.

- RSI holds bullish momentum above neutral at 58.10, while MACD signals cooling without breakdown, keeping the trend intact near $170.

- Long-term structure suggests potential moves to $233 and beyond if the ascending channel holds and $180 resistance is breached.

Solana (SOL) maintains a disciplined uptrend within a defined ascending channel stretching from early April through late May. The pattern shows persistent higher lows and higher highs, backed by volume and key support reactions across the structure.

Support Structure Remains Intact Near $170

SOL’s price continues to respect the channel’s lower boundary , bouncing four times from dynamic support since early April 2025. The latest daily candle, dated May 21, closed at $169.92 after ranging between $166.78 and $171.76 intraday. Volume stood at 1.48 million, reflecting stable market activity despite narrowing volatility during recent consolidation.

Source:

TradingView

Source:

TradingView

Each bounce from support triggered upward legs, confirmed by visible green volume spikes following trendline interaction. The strongest rebound occurred mid-April, lifting SOL sharply toward the upper channel without breaking structure . Profit-taking appears consistent near $180, acting as resistance but failing to break bullish momentum.

The Relative Strength Index (RSI) reads 58.10, cooling from a local peak of 65.63 recorded in early May. Momentum remains bullish above the neutral 50 level, with room to rise before reaching overbought conditions. This steady RSI behavior shows trend health, though short-term cooling could delay any immediate breakout attempt.

MACD and Volume Show Momentum Cooling, Not Reversing

The MACD currently reads 6.80, while the signal line sits slightly higher at 7.90, marking a soft bearish crossover. The histogram shows a negative value of -1.09, though the bar size has started shrinking over recent sessions. This histogram behavior often signals slowing momentum, not a breakdown, especially when MACD remains above zero.

Despite minor crossover, the overall setup remains positive with no breakdown below the rising channel’s lower trendline. Each prior pullback respected trend structure, then resumed upward once volume returned to support zones. Are RSI and MACD preparing for synchronized recovery, or will this stall stretch longer beneath $180 resistance?

Volume spikes consistently align with rebounds from trendline support, suggesting smart money defends key levels. This has led to controlled movement within the channel, with no price candle breaching below its lower range. The pattern remains clean, offering clarity for both bullish continuation and risk-managed pullbacks.

Broader Outlook Eyes $233 and $450 if Structure Holds

Javon Marks previously charted SOL’s full breakout from $16.12 to $233.80, totaling over 1,300% in gains. He now points again to $233.80 as a decisive level that, if reclaimed, could open paths toward $450+. Could the current base near $170 form a launchpad for another push into historical resistance zones?

Supporting this scenario, the long-term chart shows SOL broke a multi-year descending trendline in early 2023. That breakout led to consistently higher highs, with $120 acting as firm support during early 2025 pullbacks. Recent price action has rebounded from this level, aligning short-term momentum with long-term bullish structure.

What’s equally important, the channel’s resistance near $180 matches historical selling zones from late 2024. Price now trades just below this point, creating a tension zone between continuation and rejection. Whether bulls break above $180 or stall again will define near-term direction and possibly retest broader resistance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DWF Labs withdrew 25.77 million ASTR to its on-chain staking wallet 1 hour ago

Cetus hacked with losses exceeding $150 million

Stablecoin cross-border trading startup OpenFX completes $23 million financing, led by Accel

Cetus: Smart contracts have been temporarily suspended